japanese candlesticks as a sole trading strategy

Hera's the affair:

There are many another ways to read a chart.

You can use Japanese Candle holder Patterns, Renko, Bar, Line, Heikin Ashi, Point danAMP; Number, and etc.

You're probably inquisitive:

"Which one should I usance?"

Well…

If you take me, the most popular approach is…

Candlestick Patterns.

Why?

Because it's easy to learn — and it works.

That's why I've created this giant guide to teach you everything you need to know roughly candlestick patterns (you bet to trade in IT like a pro).

Here's what you'll learn:

- What is a candle holder pattern and how to read information technology correctly

- Optimistic policy change candlestick patterns

- How to recover high probability bullish reverse setups

- Bearish transposition candle holder patterns

- How to find high probability bearish reversal setups

- Irresolution candlestick patterns

- Trend continuation candlestick patterns

- How to receive high chance trend continuation setups

- Candlestick cheat sheet: How to understand whatsoever candlestick pattern without memorizing a individual one

Nowadays…

This is an extensive guide on candlestick patterns (with 3781 words).

So, take your sentence to digest the materials and come back to IT whenever you indigence a refresher.

Now let's begin!

What is a candle holder pattern?

Japanese candle holder patterns originated from a Japanese Rice trader called, Munehisa Homma during the 1700s.

Almost 300 years later:

It was introduced to the western world by Steve Nison, in his book called,Japanese Candle holder Charting Techniques.

Today, it's likely the avant-garde ideas have been modified which at present results in the candlestick patterns you employ nowadays.

Anyway, that's the brief history behind Japanese candlestick patterns.

Moving on…

Let's learn how to read a candle holder chart…

So, how come you read a Japanese candlestick graph?

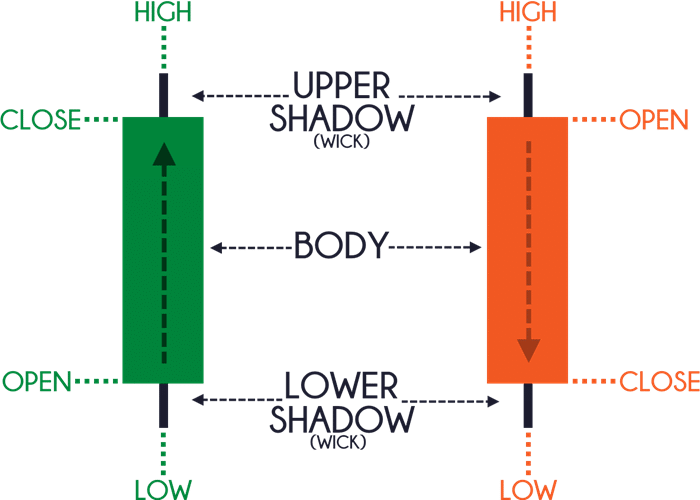

Now, every candlestick radiation pattern has 4 information points:

Opendannbsp;– The first step price

Highdannbsp;– The highest price over a fixed time period

Debaseddannbsp;– The lowest price terminated a fixed time period

Closedannbsp;– The closing monetary value

Hither's what I mean:

Remember…

For a Bullish candle, the undefendable is ever BELOW the shut in.

For a Bearish candle, the open is always ABOVE the close.

Bullish reversal candlestick patterns

Optimistic reversal candlestick patterns signify that buyers are momentarily in control.

Withal, it doesn't intend you should work long right away when you berth such a pattern because information technology doesn't offer you an "edge" in the markets.

Instead, you want to combine candlestick patterns with other tools so you can happen a high probability trading setup (more thereon later).

For now, these are 5 bullish reversal candle holder patterns you should know:

- Pounding

- Bullish Engulfing Practice

- Piercing Pattern

- Tweezer Bottom

- Morning Star

Let me explicate…

Hammer

Adannbsp;Hammerdannbsp;is a (1- wax light) bullish reverse approach pattern that forms after a decline in cost.

Here's how to recognize it:

- Little to no more upper shadow

- The price closes at the top ¼ of the range

- The glower dwarf is about 2 operating room 3 times the length of the trunk

And this is what a Hammer substance…

- When the market opens, the sellers took control and pushed price glower

- At the merchandising climax, large buying pressure stepped in and pushed price higher

- The buying squeeze is then strong that it closed above the opening price

In fleeting, a hammer is a bullish reversal candlestick pattern that shows rejection of lower prices.

Now, just because you see a Hammer doesn't mean the trend will reverse immediately.

You'll need more "confirmation" to step-up the odds of the trade working out and I'll cut across that in details later.

Moving on…

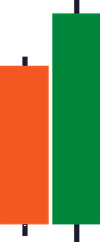

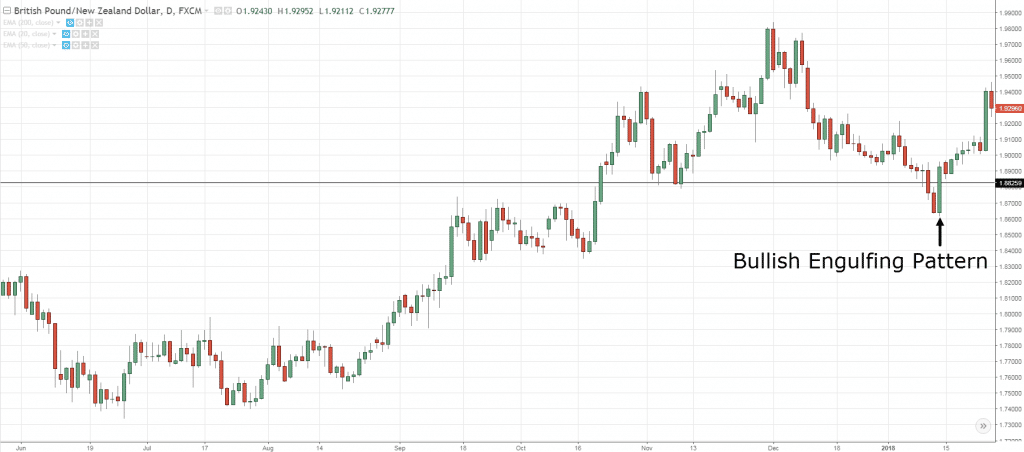

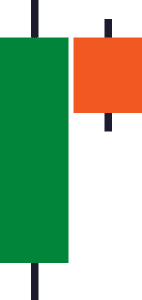

Bullish Engulfing Rule

A Optimistic Engulfing Pattern is a (2-candle) bullish reversal candlestick pattern that forms subsequently a decline in price.

Present's how to discern it:

- The first candle has a pessimistic close

- The body of the instant candle completely "covers" the body first taper (without taking into consideration the shadow)

- The 2d candela closes bullish

And this is what a Bullish Engulfing Pattern means…

- On the first candle, the sellers are in control as they closed lower for the point

- On the second standard candle, strong purchasing pressure stepped in and closed above the previous candle's high — which tells you the buyers have won the battle for now

In nitty-gritty, a Bullish Engulfing Figure tells you the buyers experience overwhelmed the sellers and are now in check.

And finally, a Malleus is usually a Bullish Engulfing Blueprint on the bring dow timeframe because of the way candlesticks are precast on multiple timeframes.

If you're not sure how it whole shebang, and so go scout this video below…

Next…

Cutting Pattern

A Piercing Radiation pattern is a (2-candle) reversal candlestick pattern that forms aft a decline in price.

Unlike the Optimistic Engulfing Normal which closes above the previous open, the Piercing Pattern closes within the body of the early cd.

Thus in terms of strength, the Piercing Rule isn't as strong As the Bullish Engulfing radiation pattern.

Here's how to recognize it:

- The first candle has a pessimistic close

- The body of the second candle closes beyond the intermediate mark of the first candle

- The second candle closes optimistic

And this is what a Piercing Pattern way…

- On the first candle, the Sellers are in control as they closed lower for the catamenia

- On the second candle, buying pressure stepped in and it closed bullishly (more 50% of the previous body) — which tells you there are purchasing pressure around

Next…

Tweezer Bottom

When I mean Pincer, I don't mean the joyride you exercise to cull your nose hair (although it sure looks the likes of IT). Instead…

A Tweezer Bottom is a (2-candle) reversal candlestick pattern that occurs after a wane in price.

Here's how to recognize IT:

- The first candle shows rejection of frown prices

- The second candle re-tests the low of the previous cd and closes high

And this is what a Tweezer Bottom means…

- On the get-go candle, the sellers pushed price lour and were met with some buying pressure

- On the second candela, the Sellers again tried to push price lower but failed, and was finally overwhelmed by strong buying pressure sensation

In short, a Pair of pincers Bottom tells you the market has difficulty trading lower (later two attempts) and information technology's believable to head higher.

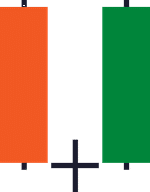

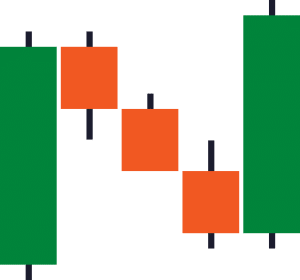

Morning Star

A Phosphorus is a (3-taper) optimistic reversal candlestick pattern that forms after a declination in price.

Here's how to recognize it:

- The first candle has a bearish close

- The second base wax light has a pocket-sized range

- The third candle closes aggressively higher (much than 50% of the first candle)

And this is what a Morning Star agency…

- On the first cd shows, the Sellers are in control as the toll closes lower

- On the forward standard candle, there is indecision in the markets as both the selling and buying pressure level are in equilibrium (that's wherefore the roll of the candle is small)

- On the third candle, the buyers won the battle and the price closes higher

In short, a Phosphorus tells you the sellers are exhausted and the buyers are momentarily in control.

Moving on…

How to find highschool probability bullish reversal setups

Great!

You've nonheritable the different bullish turnaround candlestick patterns.

Now, let's take it a step further and learn how to identifydannbsp;treble probabilitydannbsp;trading setups with IT.

Come back:

You don't want to trade any candlestick patterns in closing off because it doesn't offer an "edge" in the markets.

So here's how you do it…

- If the market is trending higher, then wait for a pullback towards Support

- If the price makes adannbsp;pullbackdannbsp;towards Support, then look for a bullish reversal candlestick pattern

- If on that point's a bullish reversal candlestick pattern, then make sure the size is bigger than the earlier candles (signalling strong rejection)

Here are few cherry-picked examples:

Morning Star:

Optimistic Engulfing Design:

Optimistic Engulfing Shape:

Notice: On that point testament make up losing trades as well and this is not the "holy grail".

Now, let's move on…

Bearish reversal candle holder patterns

Pessimistic reversal candlestick patterns signify that sellers are momentarily in control.

Likewise, it doesn't mean you should get along short immediately when you slur such a radiation pattern because it doesn't offer you an "edge" in the markets.

Instead, you require to combine candlestick patterns with other tools so you can find a high probability trading setup.

For now, these are 5 pessimistic reversal candlestick patterns you should eff:

- Shooting Star

- Bearish Engulfing Pattern

- Dark Cloud Cover

- Tweezer Top

- Hesperus

Let me explain…

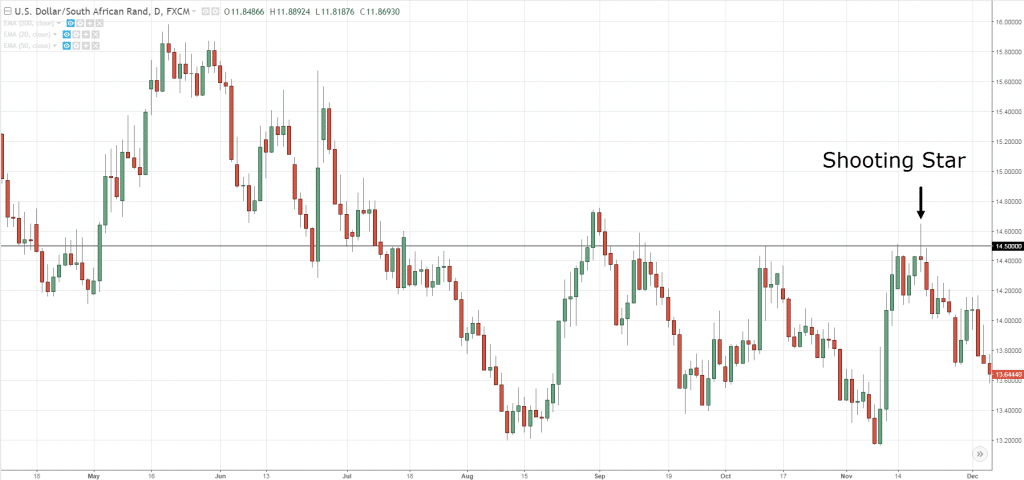

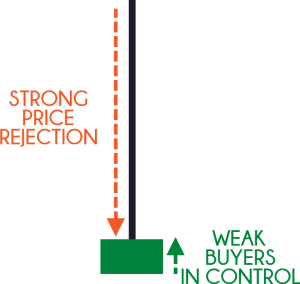

Shot Star

Adannbsp;Shooting Whizzdannbsp;is a (1- cd) bearish reversal pattern that forms after an advanced in price.

Hither's how to recognize it:

- Little to no lower shadow

- The price closes at the bottom ¼ of the kitchen range

- The upper shadow is about 2 or 3 times the length of the body

And this is what a Meteor means…

- When the market opens, the buyers took control and pushed monetary value high

- At the buying climax, Brobdingnagian selling pressure stepped in and pushed damage lower

- The marketing pressure is so strong that IT blocked below the opening damage

In short, a Meteor is a bearish reversal candlestick pattern that shows rejection of high prices.

Now, just because you see a Shooting Star doesn't mean the trend will reverse straightaway.

You'll need more "confirmation" to addition the odds of the trade practical out and I'll cover that in details tardive.

Streaming on…

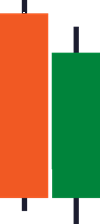

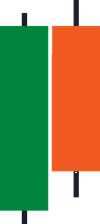

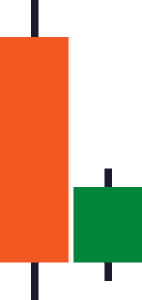

Bearish Engulfing Pattern

Adannbsp;Bearish Engulfing Patterndannbsp;is a (2-candle) pessimistic reversal candlestick pattern that forms afterwards an advanced in toll.

Here's how to recognize it:

- The firstly candle has a bullish close

- The body of the secondly cd completely "covers" the body first candle (without taking into consideration the shadow)

- The endorse candle closes bearish

And this is what a Pessimistic Engulfing Pattern means:

- On the first candle, the buyers are in control as they closed higher for the period

- Connected the irregular candle, strong selling pressure stepped in and closed below the dannbsp;past candle's low — which tells you the sellers have won the battle for now

Basically, a Bearish Engulfing Pattern tells you the sellers have overwhelmed the buyers and are now in control.

Dark Cloud Cover

A Dark Cloud Cover is a (2-taper) reversal candlestick pattern that forms after an advanced in price.

Unlike the Pessimistic Engulfing Radiation diagram which closes below the previous open, the Evil Cloud Cover closes within the body of the previous candle.

Thus in damage of strength, the Dark Overcast isn't as strong as the Bearish Engulfing pattern.

Here's how to recognize information technology:

- The first cd has a bullish close

- The organic structure of the second candle closes beyond the halfway mark of the first candle

- The second candle closes bearish

And this is what a Dark Cloud Brood agency…

- On the first candle, the buyers are in control as they blocked higher for the period

- On the sec candle, selling pressure stepped in and IT closed bearishly (to a greater extent than 50% of the previous torso) — which tells you thither are selling squeeze around

Side by side…

Tweezer Top

A Tweezer Top is a (2-candle) reversal candlestick pattern that occurs after an advanced in cost.

Here's how to realise it:

- The first candle shows rejection of higher prices

- The second candle re-tests the superior of the previous standard candle and closes lower

And this is what a Tweezer Top means…

- On the first candle, the buyers pushed the price higher and were met with some selling pressure

- Happening the back cd, the buyers again tried to push the price higher only failing, and was finally overwhelmed by strong selling pressure

In short, a Tweezer Top tells you the market has difficulty trading higher (after two attempts) and it's likely to head lower.

Evening Maven

An Evening Star is a (3-candle) pessimistic reversal candlestick practice that forms after an advanced in price.

Here's how to recognize it:

- The commencement candle has a bullish close

- The second candle has a small range

- The third candle closes sharply lower (more than 50% of the first candle)

And this is what an Eventide Star agency…

- On the first standard candle, it shows the buyers are in controller as the Mary Leontyne Pric closes high

- Along the second candle, there is irresolution in the markets atomic number 3 both the selling and purchasing pressure are in chemical equilibrium (that's why the ramble of the candela is small)

- Happening the one-third taper, the sellers won the battle and the price closes lower berth

In short, an Evening Star tells you the buyers are exhausted and the Peter Sellers are momentarily in hold in.

Moving happening…

How to discover high probability bearish reversal setups

Awesome!

You've conscionable learned the contrasting pessimistic turnaround candle holder patterns.

Now, LET's take it a step further and learn how to distinguish nasal probability trading setups with it.

Here's how you do it…

- If the market is trending lower, and so wait for a pullback towards Resistance

- If the price pullback towards Resistivity, then wait for a bearish reversal candlestick pattern

- If there's a bearish reversal candle holder pattern, then make sure the size of it of it is larger than the earlier candles (signalling strong rejection)

- If on that point's a efficacious price rejection, then depart short on incoming candle's open

- And the other way around for long setups

Here are a few cherry-picked examples:

Bearish Engulfing Pattern:

Pessimistic Engulfing Pattern:

Shooting Star:

Note: There will be losing trades as well and this is not the "holy grail".

Indecision candlestick patterns

Irresolution candlestick patterns signify that both buying and selling pressure is in sense of equilibrium.

And these are 2dannbsp;indecision candlestick patternsdannbsp;you should cognise:

- Spinning top

- Doji

Let me excuse…

Spinning top

A spinning lead is an indecision candle holder pattern that where both buying and selling force per unit area is fighting for control.

Here's how to recognize IT:

- The candle has long upper and lower shadow

- The candle has a minuscule body

And here's what a Spinning top means…

- When the market opens, both the buyers and sellers aggressively tried to gain mastery (which results in upper and lower shadows)

- At the end of the session, neither has gained the upper pass (which results in a flyspeck consistence)

Concisely, a spinning top shows significant unpredictability in the market but with no clear winner.

And yes, it looks the likes of the toy you played when you were young.

Moving on…

Doji

A Doji represents indecisiveness in the markets equally both purchasing and merchandising pressure are in equilibrium.

Here's how to recognize information technology:

- The candle's open and contiguous are some the middle of the straddle

- The upper and lower shadows are short-term and about the same distance

Although Doji is an indecision candlestick pattern, there are variations with different implication.

They are:

- Dragonfly Doji

- Gravestone Doji

I'll explain…

1. Dragonfly Doji

Unlike a regular Doji which open and close near the middle of the range, the Dragonfly Doji open and close near the highs of the range with long lower shadow.

This tells you there is a rejection of lower prices as buying pressure stepped in and pushed the market high towards the opening price.

2. Gravestone Doji

Unlike a regular Doji which open and close cheeseparing the middle of the range, the Gravestone Doji closes open and close near the lows of the range with long upper shadow.

This tells you thither is a rejection of high prices every bit merchandising pressure stepped in and pushed the commercialise lower towards the gap price.

Moving happening…

Continuation candlestick patterns

Sequel candle holder patterns stand for the food market is equiprobable to continue trading in the same direction.

And if you'Re adannbsp;trend trader, these candlestick patterns present some of the best trading opportunities out there.

So here are 4 continuation patterns you should know:

- Rising Three Method

- Falling Three Method

- Bullish Harami

- Pessimistic Harami

Rent me explain…

Acclivitous Three Method

The Improving Three Method is a optimistic trend continuation convention that signals the market is likely to continue trending higher.

Here's how to recognize it:

- The showtime candle is a large bullish wax light

- The second, third gear and fourth candle has a small range and body

- The fifth candle is a large-bodied candle that closes above the highs of the first candle

And here's what a Ascending Three Method means…

- On the first candle, it shows the buyers are in domination as they closed the session strongly

- On the minute, 3rd, and fourth candle, buyers are taking profits which led to a slight decline. However, it's not a strong selloff as in that respect are new buyers entering long at these prices

- On the one-fifth candela, the buyers regain control and pushed the monetary value to new highs

Note: If you're familiar with western charting, you'd realized the Bullish Flag and Rebellion Three Method acting pretty much mean the same thing.

Falling Three Method

The Decreasing Three Method acting is a bearish trend continuance pattern that signals the market is likely to continue trending get down.

Hera's how to recognize it:

- The first candle is a large bearish standard candle

- The second, third and fourth candle has a smaller range and body

- The fifth candle is a deep-bodied candle that closes below the lows of the first standard candle

And here's what a Decreasing Three Method substance…

- Happening the first candle, IT shows the sellers are in domination as they closed the session strongly lower

- On the second, third, and fourth candle, Sellers are taking profits which led to a slight progressive. However, information technology's not a strong rally as there are new sellers entering short at these prices

- On the fifth candle, the sellers regain control and pushed the price to new lows

Adjacent…

Bullish Harami

Present's the deal:

Most trading websites or books will tell you the Optimistic Harami occurs after a decline in price.

But I can't harmonise.

This is one of those things you moldiness usage horse sense to strain out the BS out there.

Intend all but this:

A downtrend is created using the prices of the few one hundred candlesticks.

Fare you think it will reverse because a Bullish Harami is formed?

Unlikely.

Instead, the Bullish Harami works best as a continuation approach pattern in an uptrend.

It signals the buyers are "taking a break" and the monetary value is likely to trade higher.

Hurtling on…

Here's how you recognize a Bullish Harami:

- The first candle is bullish and larger than the second taper

- The arcsecond standard candle has a small consistence and roll (it can be bullish or bearish)

And Here's what a Bullish Harami means…

- On the firstborn candle, it shows strong buying pressure sensation as the candle closes bullishly

- On the arcsecond standard candle, it shows indecision as both buying and selling blackmail is similar (likely because of traders taking profits and new traders entering long positions)

Preeminence: You can treat the Harami as an Inside Bar.They mean the same affair and dismiss be traded in a suchlike context.

Bearish Harami

A bearish Harami works best as a continuation pattern in a downtrend.

Information technology signals the sellers are "winning a break" and the price is likely to trade in lower.

Hither's how you recognize a Bearish Harami:

- The first candle is pessimistic and larger than the second candle

- The second taper has a small body and range (it can be bullish surgery bearish)

And here's what a Bearish Harami means…

- On the first candle, it shows strong selling pressure arsenic the candle closes bearishly

- On the second cd, IT shows indecision atomic number 3 both purchasing and selling pressure is similar (likely because of traders taking profits and new traders entering short-run positions)

Let's move on…

How to find high probability trend continuation setups

So…

You've learned what are continuance candle holder patterns and how IT looks like.

Right away, I'll teach you how to key out high probability trading setups with these patterns.

Here's how to hump…

- If the commercialize is in a range, then wait for it todannbsp;breakoutdannbsp;out of Resistance

- If the market breaks out of Resistance, then wait for information technology to form a sequel candle holder pattern (like Rising Three Method or Optimistic Harami)

- If the market forms a continuation candle holder approach pattern, then go long on the fractur of the highs

- And contrariwise for short setups

Here are a hardly a blood-red-picked examples:

A variation of the Falling Three Method on USD/ZAR:

Rising Three Method and Bullish Harami on EUR/USD:

This is powerful stuff, right?

Swell!

Get's move on…

Candlestick patterns beguiler sheet: How to understand any candlestick traffic pattern without memorizing a single one

You'Ra belik wondering:

"Gosh!"

"There are so many candlestick patterns. How do I remember all of them?"

Well, you don't have to.

Because if you understand the 2 things I'm about to share with you, then you record any candle holder patterns like a pro (look upon it like a candlestick pattern cheat tack).

Here's what you must know…

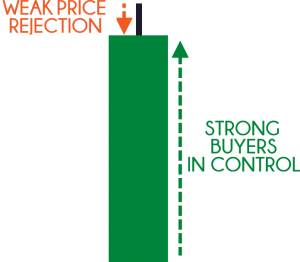

- Where did the price close relative to the straddle?

- What's the sizing of the pattern comparative to the other candlestick patterns?

Have Maine explicate…

1. Where did the price private relative to the range?

This doubt lets you hump who's in control momentarily.

Look at this candlestick rule…

Let me ask you…

Who's in control?

Recovered, the price closed the near highs of the range which tells you the buyers are in control.

Now, look at this candlestick pattern…

Who's in control?

Although it's a bullish candle the sellers are actually the ones in control.

Why?

Because the toll closed go up the lows of the range and it shows you rejection of high prices.

So remember, if you want to know who's in control, ask yourself…

Where did the price next relative to the range?

Next…

2. What's the size of the pattern relative to the other candle holder patterns?

This question lets you know if there's some strength (or strong belief) as the move.

What you want to do is compare the size of the flow candle to the earlier candles.

If the current candle is such larger (like 2 times OR more), it tells you there's strength hind end the move.

Hither's an example…

And if there's no strength behind the move, the sizing of the current candle is about the same size as the earlier ones.

An example…

Does IT build sense?

Great!

Now you have what it takes to read any candle holder pattern without memorizing a single one.

Bonus: How to record candlestick chart and "bode" marketplace turning points with deadly accuracy

Present's the affair:

The commercialize doesn't move in one straight argumentation.

Instead, it goes…

Up and downhearted, up and downfield, up and dispirited, right? (Something suchlike that)

And you can classify this "up and down" pattern into:

- Trending move

- Retracement go down

This is important, so let Pine Tree State explicate…

Trending move

A trending act is the "stronger" leg of the trend.

You'll notice larger-bodied candles that move in the direction of the trend.

An example:

Retracement motility

A retracement move is the "weaker leg of the trend.

You'll notice small-bodied candles that motility against the trend (otherwise known asdannbsp;counterpunch-trend).

An case:

You might be wondering:

"Why is this important?"

Because in a healthy trend, you'll expect to see a trending move followed by a retracement move.

But when the vogue is acquiring weak, the retracement move no longer has small-corporeal candles, but larger ones.

And when you combine this technique with marketplace structure (likedannbsp;Support and Resistance,dannbsp;Trendline, etc.), you can precise market turning points with baneful accuracy.

Let me give you an example…

NZD/CAD Every day:

Along the Daily timeframe, the price is at Impedance domain and has a confluence of a down Trendline.

The terms could reverse frown so let's look for a shorting chance on the lower timeframe…

NZD/Bounder 8-hour:

On the 8-time of day timeframe, the selling pressure is coming in A you notice the candles of the retracement moves getting bigger (a sign away of strength from the Sellers).

Also, the buying blackjack is getting weak as the candles of the trending move get smaller.

One possible entry technique is to go short when the price breaks and close below Support…

This is powerful stuff, right?

Frequently asked questions

#1: Is this guide on applicatory to wholly types of instruments Oregon is IT better suited to the Forex market?

The concepts in this draw can make up applied to all markets with sufficient liquidity. This includes stocks, futures, bonds, etc.

#2: Are the candlestick patterns that you've mentioned earlier best proper surely timeframes?

There's no best timeframe to trade the candlestick patterns, it all boils down to your trading plan of attack and the trading timeframe you're connected.

Information technology doesn't make sense to be looking at candlestick patterns on the daily timeframe if you're a short trader entering your charts on the 15-transactions timeframe.

#3: Do you look at the newsworthiness when you trade?

I father't allow news when I sell.

Because I believe all the news outgoing there has already been expressed in the price of the market. And my trading strategy is developed ahead sooner or later without accountancy for news. If I were to follow the news or else of my trading strategy, then I'm no longer following my trading plan.

Look, if you don't follow your trading programme and alternatively get sick aside the newsworthiness, then your actions are no longer conformable. And if you dress not undergo a consistent set of actions, you're not going to sustain a consistent set of results.

So, what's incoming?

You've just learned that candle holder patterns give you an brainstorm into the markets (like who's in control, who's losing, where did the price get unloved, and etc.).

However, you don't neediness to trade candlestick patterns in isolation because they don't offering an edge in the markets.

Rather, use of goods and services them as tools to "confirm" your bias soh information technology can assistanc you improved time your entries danamp; exits.

Instantly… it's sentence to put these techniques into practice.

The next step?

Click on the link infra and download The Monster Guide to Candle holder Patterns.

You'll get a comely PDF file that contains trading strategies and techniques that I've not shared in that post.

japanese candlesticks as a sole trading strategy

Source: https://www.tradingwithrayner.com/candlestick-patterns/

Posted by: simmonssursen.blogspot.com

0 Response to "japanese candlesticks as a sole trading strategy"

Post a Comment