How To Read Forex Candlestick Charts

- Reviewed past James Stanley, Dec. 15, 2021

Reading candlestick charts – Talking points:

- Candlestick charts differ profoundly from the traditional bar chart

- Traders generally prefer using candlestick charts for mean solar day-trading considering they offer an enjoyable visual perception of price

- It'south important to understand the central components of a candle, and what they point, to apply candlestick chart assay to a trading strategy

What is a candlestick chart?

A candlestick chart is simply a chart composed of individual candles, which traders employ to understand price activeness. Candlestick price activity involves pinpointing where the price opened for a menstruum, where the price closed for a menstruation, besides every bit the toll highs and lows for a specific period.

Price action can give traders of all financial markets clues to trend and reversals. For example, groups of candlesticks can form patterns which occur throughout forex charts that could signal reversals or continuation of trends. Candlesticks tin can also form individual formations which could indicate buy or sell entries in the market.

The period that each candle depicts depends on the time-frame chosen by the trader. A popular fourth dimension-frame is the daily time-frame, so the candle will depict the open, shut, and high and low for the day. The different components of a candle can aid yous forecast where the cost might get, for instance if a candle closes far below its open information technology may indicate farther price declines.

Boost your chart patterns expertise with our interactive quiz!

Our Forex Trading Patterns Quiz will test your noesis of some of the almost of import trading patterns. Take the exam today by clicking on the link and heighten your technical analysis game!

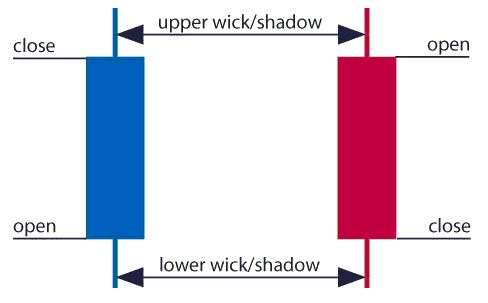

Interpreting a candle on a candlestick chart

The prototype beneath represents the pattern of a typical candlestick. There are three specific points (open, close, wicks) used in the creation of a toll candle. The first points to consider are the candles' open and close prices. These points identify where the price of an asset begins and concludes for a selected period and will construct the body of a candle. Each candle depicts the price movement for a certain catamenia that you cull when you look at the chart. If yous are looking at a daily chart each individual candle will display the open, close, upper and lower wick of that twenty-four hour period.

Open price:

The open cost depicts the commencement cost traded during the germination of the new candle. If the price starts to trend upwards the candle volition turn light-green/blue (colors vary depending on chart settings). If the price declines the candle will turn red.

Loftier Toll:

The meridian of the upper wick/shadow indicates the highest toll traded during the period. If there is no upper wick/shadow it means that the open price or the close price was the highest price traded.

Low Price:

The lowest price traded is the either the price at the bottom of the lower wick/shadow and if at that place is no lower wick/shadow and so the lowest cost traded is the same as the close cost or open price in a bullish candle.

Close Toll:

The close price is the last price traded during the period of the candle formation. If the close price is beneath the open price the candle will turn red as a default in about charting packages. If the close toll is in a higher place the open price the candle will exist green/blue (also depends on the chart settings).

The Wick:

The next important element of a candlestick is the wick, which is also referred to every bit a 'shadow'. These points are vital as they show the extremes in price for a specific charting period. The wicks are quickly identifiable as they are visually thinner than the torso of the candlestick. This is where the strength of candlesticks becomes apparent. Candlesticks can aid traders keep our centre on market momentum and away from the static of price extremes.

Direction:

The direction of the price is indicated by the color of the candlestick. If the price of the candle is endmost above the opening price of the candle, then the price is moving upwards and the candle would be green (the colour of the candle depends on the nautical chart settings). If the candle is cerise, and so the price closed below the open up.

Range:

The difference between the highest and everyman price of a candle is its range. You can calculate this by taking the price at the summit of the upper wick and subtracting it from the price at the bottom of the lower wick. (Range = highest point – everyman point).

Having this cognition of a candle, and what the points indicate, means traders using a candlestick chart have a clear reward when it comes to distinguishing trendlines, cost patterns and Elliot waves.

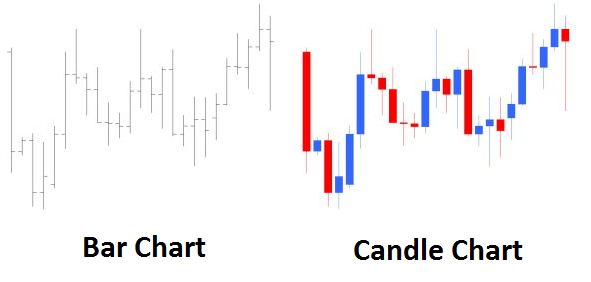

Bar Chart vs Candlestick Chart

Equally you tin can see from the image below, candlestick charts offer a distinct advantage over bar charts. Bar charts are not every bit visual equally candle charts and nor are the candle formations or cost patterns. Also, the bars on the bar chart arrive difficult to visualize which direction the price moved.

How to read a candlestick chart

There are various ways to use and read a candlestick chart. Candlestick chart analysis depends on your preferred trading strategy and fourth dimension-frame. Some strategies attempt to take reward of candle formations while others attempt to recognize price patterns.

Interpreting single candle formations

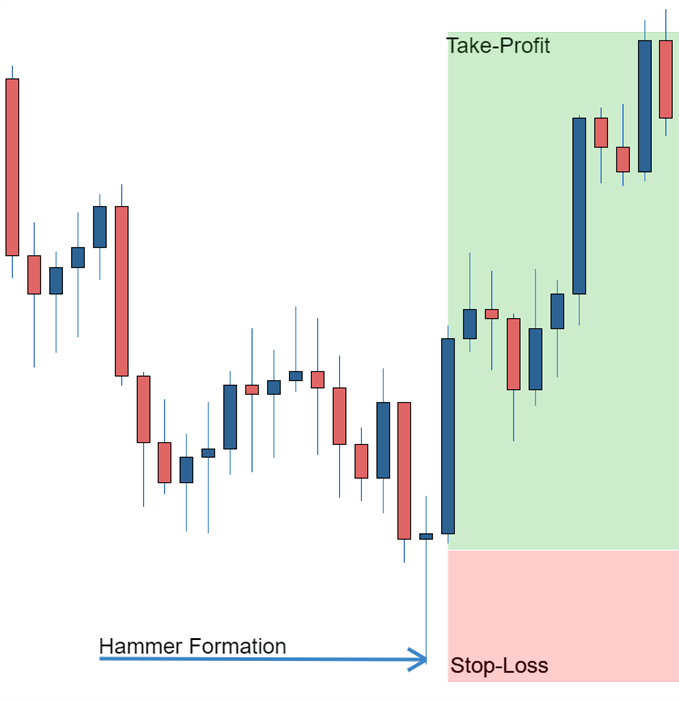

Private candlesticks can offer a lot of insight into current market sentiment. Candlesticks similar the Hammer , falling star , and hanging man, offer clues as to changing momentum and potentially where the market prices maytrend.

As you can meet from the epitome below the Hammer candlestick formation sometimes indicates a reversal in tendency. The hammer candle formation has a long lower wick with a minor body. Its endmost pricing is higher up its opening price. The intuition behind the hammer germination is simple, price tried to decline but buyers entered the market pushing the price upwards. It is a bullish bespeak to enter the market, tighten stop-losses or shut out a short position.

Traders tin can take reward of hammer formations by executing a long trade once the hammer candle has closed. Hammer candles are advantageous because traders can implement 'tight' stop-losses (terminate-losses that risk a small amount of pips). Accept-profits should be placed in such a way as to ensure a positive gamble-reward ratio. So, the take-profit is larger than the stop-loss.

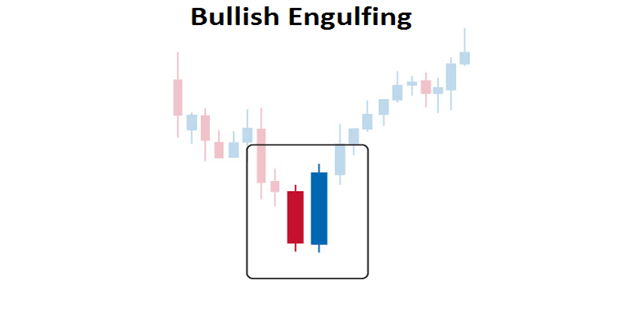

Recognizing price patterns in multiple candles

Candlestick charts help traders recognize price patterns that occur in the charts. By recognizing these cost patterns, like the bullish engulfing pattern or triangle patterns y'all can have advantage of them past using them every bit entries into or exit signals out the market place.

For example, in the image below we have the bullish engulfing price design. The bullish engulfing is a combination of a red candle and a blue candle that 'engulfs' the entire red candle. It is an indication that information technology could be the stop of a currency pairs established weakness. A trader would take advantage of this past entering a long position after the blueish candle closes. Think, the cost pattern only forms once the 2nd candle closes.

As with the hammer formation, a trader would place a stop loss below the bullish engulfing pattern, ensuring a tight stop loss. The trader would then gear up a take-turn a profit. For more forex candlestick charts check our forex candlesticks guide where we go in depth into the advantages of candlestick charts besides as the strategies that can exist implemented using them.

Further tips for reading candlestick charts

When reading candlestick charts, be mindful of:

- The time frames of trading.

- Archetype price patterns.

- Price action.

At DailyFX we offer a range of forecasts on currencies, oil, equities and gold that can aide you in your trading. It is also worth post-obit our webinars where we present on a variety of topics from toll-action to fundamentals that may affect the market place.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

How To Read Forex Candlestick Charts,

Source: https://www.dailyfx.com/education/candlestick-patterns/how-to-read-candlestick-charts.html

Posted by: simmonssursen.blogspot.com

0 Response to "How To Read Forex Candlestick Charts"

Post a Comment