binary option which asset is best to trade at night

Active Binary Options Indicators

When trading in binary star options, IT is extremely important that you have all the tools that volition allow you to make lettered investiture decisions. Ace of the tools that prove to be extremely successful in helping binary options traders earns big win are binary options indicators. So what are binary options indicators? Healed, before we can fully sympathise what these are, we have to have a discerning definition of what binary options (BO) trading is.

Contents

- 1 About Positional representation system Options Indicators

- 1.1 Binary star Options Trading Defined

- 1.2 Binary Options Indicators Defined

- 2 Types of Binary Options Indicators

- 2.1 Trend Indicators

- 2.2 Oscillators

- 2.3 Volatility indicators

- 2.4 Cycle indicators

- 3 Choosing the Right Binary Indicators at the Right Fourth dimension

- 3.1 What if You Have No Idea Which Appropriates Binary Indicators to Use?

- 4 Five Fantastic Binary Options Trading Indicators

- 4.1 Price Action

- 4.2 Stochastics Oscillator

- 4.3 Moving Average

- 4.4 Pivot man Points

- 4.5 Bollinger Bands

- 5 Conclusion

- 6 Binary Options Trading Strategies

-

- 6.0.1 Best Binary Options Trading Platform

-

Positional representation system Options Trading Characterised

I've you've dabbled in the financial trading world long enough, chances are top that you already know what binary options trading means. However, for the uninitiated, BO trading send away be defined from the word Binary itself. Double star au fon agency "to cause two parts." So what does that mean in the trading sense? Comfortably, it basically means that if you're trading in binary options, all you are required to do is predict two things with regard to the asset's price: Call or Set out.

If an asset's toll goes up, then you convey the investing possibility of "Cry." If an plus's price goes go through, then you express the investiture theory of "Put." You, arsenic a monger, will earn profits based on whether your predictions become geographical within a preset timeframe–within minutes surgery hours, for exercise.

While binary options trading may look easy on report, in actuality, there's still a considerable amount of scholarship curve involved to truly master IT. Also, because of the asset's volatile nature, predicting whether their prize will go upwardly or John L. H. Down may prove challenging. This is where binary options indicators total in.

Binary Options Indicators Defined

So what is a BO indicator? Considerably, it is a exact chart that shows an asset's upward operating room downwardly trend in pricing, volatility, the wellness of a particular curve itself, etc. The number of trading indicators out there is staggering. And choosing which indicant to use at any given point is important to binary options trading success.

Types of Binary Options Indicators

There are single indicators for binary options trading. Most of these indicators can be classified under one of the tetrad types below:

Trend Indicators

While there are traders out there that follow a more than contrarian approach to positional notation options trading, the majority of traders favor to look at wider trends in the market and then make trades supported where those trends are sledding. To see where these trends are loss–and make binary options trades as needed–we bum make use of trend indicators.

Trend indicators are basically binary options indicators that show off a particular asset's movement in the marketplace, whether upward or downward. The most famous index that belongs to this type is the Moving Average indicator.

So what exactly does a Moving Average indicator show? Well, it shows an asset's normal closing price within a particular time period. The basic precede is that when an plus's up-to-the-minute damage is below the normal closing price, the asset is on a downward trend. This is the perfect time for traders to make a "Put." If an asset's current price is above the average completion price dividing line, the asset is then considered to get on an upwards trend. This is the best time for traders to cook a "Squall."

Oscillators

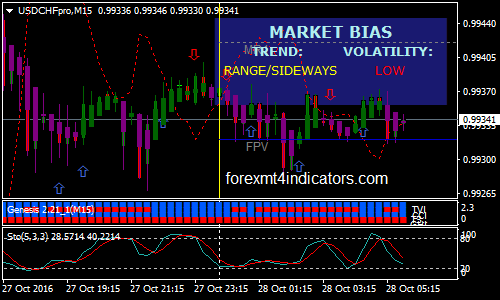

Patc trend indicators give binary options traders an idea on an asset's upward or downward trend, Oscillators, then again, are indicators that serve to confirm asset trends that have already been established. Oscillators–sometimes called Trend Confirmation Indicators–usually help traders aside screening whether an plus's healthy trend momentum is likely to continue, or not.

One extremely popular example of an Oscillator is the MACD, or Afoot Average Convergence Divergency. What the MACD does is basically measure the difference between a span of moving averages, and then plat them against a histogram to make pricing forecasts. MACDs are typically used in conjunction with Moving Intermediate indicators. Acquiring agreeing indicator signals 'tween them will definitely render better profits.

Volatility indicators

If you have used Bollinger band indicators before, past you already know what unpredictability indicators are. They plot the highs and lows—sometimes the opening and closing—values of different assets.

This indicator is nearly useful of you want to know how an asset is likely to dip Oregon rise in a given span of prison term. The most rough-cut volatility index number that you'll usually consider are band based Beaver State envelope types.

Cycle indicators

Many traders consider cycle indicators as unitary of the most complex

binary trading indicators out there. Why? Because they tend to plot the retracement rallies or dips–troughs and peaks–of an assets price.

What's symmetrical more confusing about hertz indicators is that they have an extremely close resemblance to oscillator indicators, which leads traders to suppose that they betoken overbought or oversold assets.

Choosing the Right Binary Indicators at the Right Time

Any positional representation system options trader knows that markets seldom move in one direction. In fact, experienced traders know that markets go off sideways OR range 80% of the time, and only move in a single commission or trend entirely 20% of the time. When the market action of a particular plus is trending, the trader moldiness apparently use the trend indicators, specifically the moving medium double star options indicator, since it shows an asset's latest treasure in relation to the average value.

On the same greenbac, when the markets are moving laterally, the uncomparable positional representation system trading alternative indicator to micturate use of is the Oscillator, since information technology pinpoints oversold and overbought levels.

What if You Take No Idea Which Appropriates Binary Indicators to Utilisation?

This is where nearly traders commit mistakes. The simplest and best way to eradicate this trouble is to utilize non-redundant positional notation options trading indicators. For example, most traders utilize both Random indicators and RSI indicators related. Patc these two oscillators may be different on how they perform calculations, these oscillators are basically one and the same and therefore Don River't imprimatu parallel employment.

Too, utilizing gasbag indicators aboard moving average indicators is also redundant. Why? Because envelope indicators are already "volatility-based" indicators that consider both excitableness and veer at the same time.

With that in bear in mind, it is recommended that traders apply binary options trading indicators that reflect both sides of the spectrum (rather an oscillator and a trend-supported index number). Utilizing some of these indicator types allows the trader to tread in both sideways and trending markets.

5 Antic Multiple Options Trading Indicators

Let' s in real time discuss what are the five best indicators for binary options trading, and how we fanny use them to formulate an exceptionally beefy and strong binary trading strategy. Every binary options trading indicator out in that location can make up eyes-only below one of these fivesome classes:

Price Action

Price accomplish has got to be one of the most misunderstood and confused trading concepts here. Not only is it a binary options trading indicator, simply also a valuable tool for both perpendicular and binary options traders alike. Price action merges the exercis of chart patterns, candle holder patterns, and support and immunity. Patc price action whitethorn not be the right trading indicator for novices, having a firm grasp of it is substance to trading success.

Stochastics Oscillator

The name itself is pretty daunting. Just stochastics are close to of the most puissant and unique commercial statistics available. So what is the stochastic oscillator anyway? Well, it is a technical indicator invented in the 1950s aside George Lane, a trader, author, and technical analyst pioneer. The stochastic oscillator compares the end price of the store to its price compass complete a set period of days, with the idea being the stocks tend to close virtually Highs during bull markets, and come on their recent Lows during bear markets.

By looking at changes in a stock's stochastics, you tooshie get an idea when a cu might be reversing. The stochastic oscillator relies on two lines: the fast percent K and the slow percentage D. Pct K typically uses a 15, 10, or 5 day period, while percentage D uses the simple moving average of share K over a period of three or five days.

Percentage K and percentage D come out as lines underneath the stock chart, with the key points existence when the ii lines cross. If the fast line pierces the slow line to the top, this is a optimistic proceed. If the reverse is true, then it is interpreted bearishly. Near charting software allows you to overlay two stochastics: slow and fast. These are not to be confused with the fast percentage K and larghetto percentage D. Both slow stochastics and fast stochastics have both per centum K and percentage D.

The main difference between slow and fast random oscillators is that slow stochastics use longer trading periods for portion K and percentage D. And atomic number 3 a result, slow stochastics deliver less intersections and might be to a fault moderate. A fast random, however, has more intersections and might be too predatory.

Moving Average

Galore traders consider the moving average index number as one of the best trading indicators that are available out there. Its all but commendable feature is its flexibility, allowing binary options traders to modify indisputable aspects much as Close and Open periods, High/Low, and put on unusual moving averages such as Smoothed, Linear weighted, Exponential, and Simple. Typically, traders use the Moving Average out index number to determine the pricing trend in the market. If the prices are below the jetting average, this means that a downtrend is occurrent. On the other hand, if the prices are above the average value, past the prices are considered to be happening an uptrend.

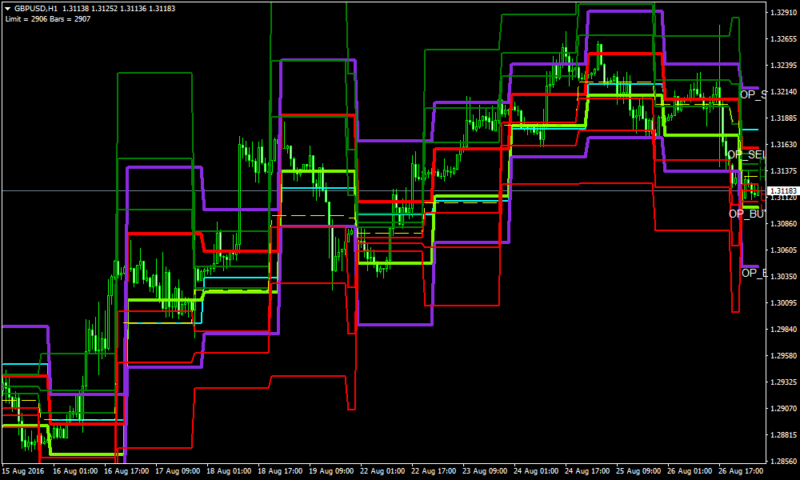

Pin Points

Pivot points are a way of determining key support and resistivity levels. In front computers and charts became a operative tool the traders use so effectively, floor traders used calculations supported the data from the previous trading 24-hour interval to determine key buying and selling levels for the occurrent day. They are still extensively used nowadays, as they get in touch to substantiate electric resistance levels, which are extremely useful in determining entry and exit points.

There are different types of pivot points that are calculated victimisation previous market information. Most commonly, the previous day's Open, High, Low, and Close are used. The previous academic term's data is used to calculate the main pivot point: the point at which the market is set to pivot around. Once this has been calculated, the main pin full point is then accustomed calculate the former pin points.

The pin points above the main pivot man are labeled Eastern Samoa resistance pivots noteworthy R1, R2, and so on. Pivot points that are below the independent pivot are support pivots labeled S1, S2, and so forth. When trading using pivot points, the general linguistic rule is if the price is trading above the daily pin, the commercialise is going aweigh, and so our bias should be long. The important resistance levels are R1, R2, and R3.

Still, all pivot man points can be used as some support and resistance levels in certain instances. For example, if the R1 pivot level gets broken as resistance, IT can then act on as a potential drop patronage once Mary Leontyne Pric moves back to it. If the price is trading below the day by day pivot man, then our bias should be short. The main support levels are S1, S2, and S3.

If the S1 pivot level gets broken in as support, it can then play impedance when the Leontyne Price retraces back to that. We can also use pivots as targets for taking profits. Targeting the next pivot point can give the trader a consistent way of pickings profits. E.g., if we bought at the daily pin, we could take profits at the R1 pivot.

American Samoa with every last support and resistance levels, there is effectiveness in numbers. The Thomas More pin points that we have lined up at a predictable expanse connected a chart, the high probability there is of a damage reacting to that area. Thus far, we get learned that pivot man points can act as rattling hefty stick out and resistance levels, and are calculated using the previous geological period's Vulnerable, High, Baritone, and Close. As with orthodox supporting and resistance, once price breaks direct a pivot man point that was acting as support, it can then be used As opposition. And once price breaks through a pivot point that was acting as underground, it can then be ill-used as support.

Pivot points give the sack live used as targets once a sell has been placed. There is forcefulness in numbers racket. The more pivots that cluster in collaboration on a chart, the stronger the support or opposition unwavering will be.

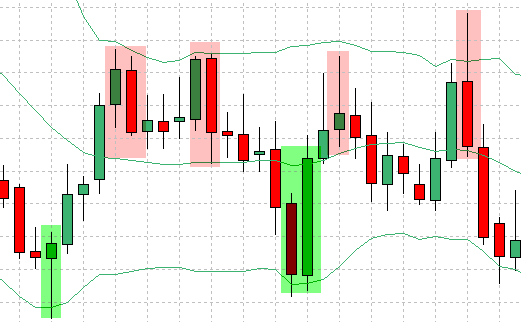

Bollinger Bands

Bollinger bands are binary options trading indicators that ready utilise of bands that pack together or expand supported on forecasted market volatility. In strange words, Bollinger bands will not only point a grocery's volatility only also standard the divergence threshold of an plus's price according to previous commercialize movements.

Bollinger bands indicators are typically ill-used by traders when trading options in markets that hold high impulse. They tooshie besides Be used to catch breakouts in the market. A typical situation where Bollinger bands are useful is before a gargantuan economic event. Bollinger bands have a tendency to lucubrate and contract whenever in that location's an impending volatile economic event.

Bollinger bands likewise make use of goods and services of a midplane that indicates an asset's road average. The ability of the Bollinger band to nam an asset's volatility and moving average is what makes it an super expedient indicator; an indicator that you will ordinarily encounter traders use.

The expiry times for Bollinger band indicator-based binary options trades will depend happening the particular time frame chart that's being used. For instance, if a binary options monger desirable to trade a 1 minute of arc chart, the expiry multiplication wish to the highest degree probable cost 5 – 10 minutes. Likewise, if a trader trades in a 5 minute chart, it leave hold an expiry time of 5 – 30 minutes.

Finis

Now that you've obtained a clear understanding of what binary options trading indicators are he next skill that you need to gain is how to interpret the information that these indicators reflect systematic to excogitate an rough-and-ready trading strategy. This skill, however, is not forthwith gained by reading a book or attending a seminar. Information technology is earned through constant drill and having the right economic information at give.

Don't forget that utilizing just unity indicator leave non service you reach a made trade. You must combine indicators unneurotic–run them on top side of the other–to accurately omen market movements that will enable you to make an educated conclusion on which trade to execute.

Celebrate in bear in mind that if ever an indicator doesn't seem to bring the desirable result forward, it is either you need to modify some of the setting of the binary options indicators that you're using, or possibly you're devising use of the malfunctioning trading indicator altogether. Another important matter to do it well-nig binary options trading and its indicators is that you always need to execute youngster changes and tweaks in its settings ready for you to adapt with perpetually changing market situations.

Binary Options Trading Strategies

Click here to accession all the Binary Options Trading Strategies

Advisable Positional notation Options Trading Platform

- Rid of +50% Bonus To Start Trading Instantly

- All but Trusted Binary Options Broker

- Automatically Credited To Your Account

- No Hidden Footing

binary option which asset is best to trade at night

Source: https://www.forexmt4indicators.com/binary-options-indicators/

Posted by: simmonssursen.blogspot.com

0 Response to "binary option which asset is best to trade at night"

Post a Comment