trading nadex weekly binary options for short term profit

Thomas has been interested in trading since October 5th, 2005. He has been following binary options since 2011 and trading NADEX since 2013.

Iv Steps To Trading NADEX Binary Options

There are 4 basic steps to trading NADEX binary options. It is very piece of cake once you become familiar with the platform.

- Selection your underlying: NADEX offers about three dozen assets based on the major problems traded today. This isn't as much equally what a European style banker will offering but no big bargain. All the major indices are included too as eight currency pairs, seven commodities, and 2 economic events.

- Option your expiry: NADEX has expiries on an intraday, end of 24-hour interval, end of week and sometimes end of month basis. At this time you lot will take to selection your strike which is different from European way options. Euro-fashion binary options only take 1 strike, the price of the underlying at the time of purchase. NADEX binary options are listed with multiple strikes whose prices fluctuate with the price of the underlying. The price you pay is the current market price as listed.

- Pick buy or sell: This is a major difference from European style. With Euro-style binary options, you buy a phone call when you are bullish and a put when yous are bearish. NADEX binary options trade in a fashion akin to futures and spot forex. When you are bullish you lot buy the pick and when yous are bearish you sell it. Buying is adequately self-explanatory; when yous are bullish on an option you buy. Selling takes a little getting used to. When you sell a binary option you receive the bid price. This a credit position in which you risking $100 minus that amount. At that place is more info on that afterward on.

- Choice trade size: With European mode binary options, your trade size is whatever amount you cull between the broker'southward minimum and maximum merchandise. NADEX options are different. In this respect, they are akin to equity options. Each option is based on a lot of 100 shares. Each share is priced between $0.00 and $1.00 making each option worth 100 ten the option price. An option that is priced at $0.35 costs $35 dollars to buy and receives $35 if sold. Minimum trade size is i lot, to make a bigger trade buy or sell equally many lots as you would similar, up to the maximum.

How NADEX Binary Options Are Priced

NADEX binary options are not priced in the same way as European style binary options. NADEX options are worth $0 or $100 at the time of expiration. If your pick is in the money you lot receive $100 and if it is out of the money you receive $0. During the options life, its value will fluctuate along with the underlying asset. The price you pay is the spot price of the option at the time of purchase. Deep in the coin options are usually worth shut to $100 making them an attractive sell. Options far out of the coin are normally worth far less. Some trade every bit low equally $0.25 or lower. These are attractive options for those who prefer to purchase and are expecting a large move.

- NADEX binary options are worth $0 or $100 at expiration. The price you lot pay is the spot price of the option, somewhere betwixt $0 and $100. Your potential profit is $100 minus the corporeality y'all adventure. If you lot buy an option for $65 and receive $100 at expiration you are risking $65 for a potential $35 (53.eight%) profit. If you sell an pick and receive $65 in credit you are risking $35 for a potential 185.seven% profit.

NADEX Binary Options

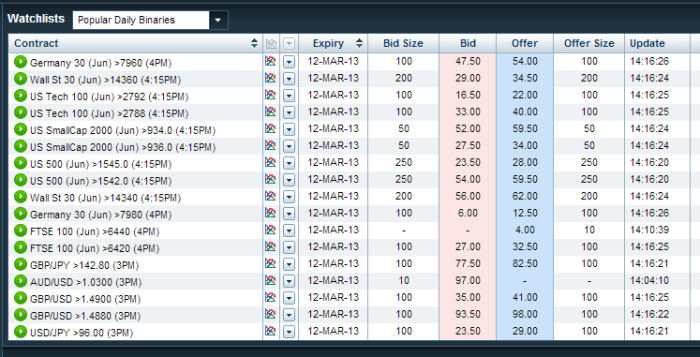

NADEX has binary options on all the major world indexes, forex pairs and ordinarily traded bolt.

TMHughes CC ASA 3.0

Pick an Underlying

The first stride is 1 of the easiest to make, option an underlying. I suggest picking i of the major indices, one forex pair, and 1 commodity to keep on your lookout list.

I merchandise the Southward&P 500 and notice that it is enough to keep me busy. NADEX options have different names only they are all based on the underlying asset The Southward&P 500 is called the The states 500, the DAX is called the German language 30 and etc.

- NADEX has all the major indices represented. You tin can merchandise the S&P 500, the Dow, the NASDAQ, the DAX, the Nikkei, and several others.

- NADEX has eight major forex pairs. Forex trading opens at 6 pm eastern time every Sunday giving early admission to international forex markets for U.S. binary options traders.

- NADEX has seven normally traded commodities. Gilt, oil, silver, corn, and others.

- NADEX has binary options on two economical events. Traders can speculate on the releases of weekly initial jobless claims or on the monthly release of the Fed Funds Rater.

- NADEX has options on Bitcoin with others in the works.

NADEX has dozens of underlying assets. NADEX has intra-day, end of day, end of week and sometimes longer death on a basketful of underlying assets.

TMHughes CC ASA 3.0

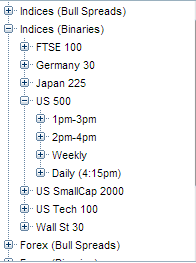

NADEX Has Multiple Strikes for Each Decease

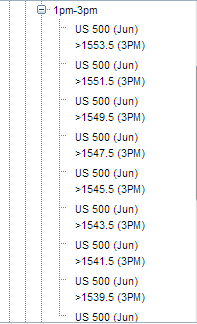

The picture show below shows a listing for all the expiries for the The states 500 (S&P 500) at 3 pm on the given day. You can see that this asset has strikes set in $ii increments. strikes will exist different for each asset and expiry.

Choosing the right strike is one of the hardest parts of trading NADEX, or whatever kind of options. Any could produce profits but non all will, and not all come with the same gamble.

- NADEX intra-day options elapse at set times periodically throughout the solar day. Expiries vary from asset to asset.

- NADEX daily binary options elapse at the stop of each trading day according to the representative market. Commodities are based on the U.S market where each is primarily traded. Equities at 4:15, some commodities and forex at three pm, Oil at two pm. Currencies trade but about around the clock though and have multiple expiries.

- NADEX weekly binary options expire at the finish of the trading calendar week. This would be Friday or the last business solar day of the week in the event of a holiday. The fourth dimension of decease is the aforementioned equally if information technology were a daily.

This is a NADEX intra solar day expiry. NADEX has multiple expiry'south and strike prices for intra-day and longer term trading.

TMHughes CC ASA 3.0

Purchase or Sell?

The next footstep is to choose to buy or sell. If yous are bullish on an option, that means you recollect the underlying is going to close higher than the strike toll, then you buy. If you lot retrieve information technology isn't going to happen you sell.

Read More From Toughnickel

Let's look back at the concluding picture. All the strikes for the S&P 500 options with three PM decease are listed every bit US500> the strike toll. If y'all are bullish and think the US500 is going to be >1535 at 3 PM then you buy. If you think in that location is no take a chance that the US500 going to be >1535 at iii PM then you sell.

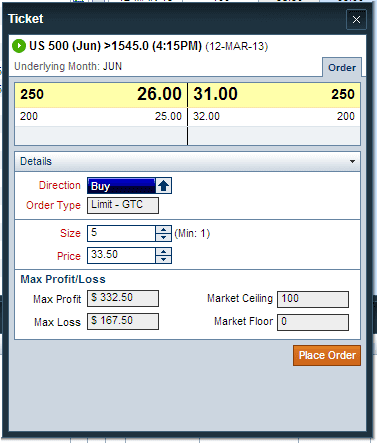

The flick beneath shows a NADEX society ticket. This is an social club to purchase a call at $33.50 with an end of day expiration and strike greater than 1545.

Selling NADEX binary options is a credit position. Y'all receive the bid price and risk the deviation between that credit and $100. Considering all NADEX options are greenbacks-secured you must maintain that amount in your account until expiration. Other than that in that location are no other margin requirements trading NADEX, anyone with an account and enough cash to cover the risk can sell NADEX options.

NADEX Order Screen For Binary Options

NADEX club screens are piece of cake to utilise. This 1 shows the bid/ask, underlying, decease, risk and advantage.

TMHughes CC ASA 3.0

Pick Your Trade Size

As I described in a higher place NADEX binary options don't merchandise in quite the same way every bit European style options. NADEX options merchandise in lots and each lot represents 100 shares of stock. Prices are quoted on a per-share basis merely options are purchased in lots. This ways that an pick priced at $0.47 really costs $47 to purchase and will receive $53 if sold.

If you lot want to trade $500 dollars you lot must buy 10 lots of this option ($47x10=$470). If you are selling this option the same multiplier event is applied to your take a chance and the corporeality of cash yous will have to keep in your business relationship.

NADEX Has Binary Options On Economic Events

1 of the exotic instruments gaining popularity in the binary options world is economic events. These are pick positions on whether or non something will happen. For example, NADEX offers binary options on two different events. These are the Fed Funds Rate and weekly Jobless Claims.

Traders can choose positions based on these figures. If the market place expects the FOMC to raise the target overnight charge per unit and so traders tin can buy options reflecting that opinion. The same is true of jobless claims. Traders cull positions based on whether or not the weekly initial jobless claims effigy will be greater than or equal a certain level. Multiple strikes are offered for both types of options.

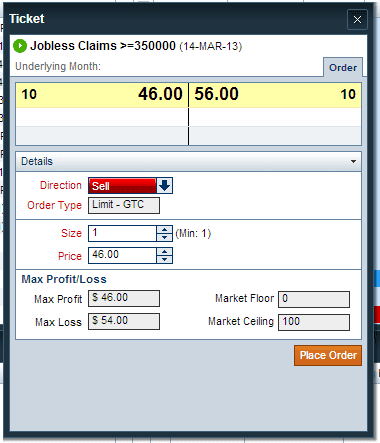

The example below shows an order ticket selling initial jobless claims at 355,000. This is a bearish position on claims that expects the actual number to be less than 355,000.

NADEX Economic Events Binary Options

You can even trade economical events with NADEX binary options. This example is a sell on Jobless Claims greater than or equal to 350K.

TMHughes CC ASA 3.0

This article is authentic and truthful to the best of the author's knowledge. Content is for informational or entertainment purposes merely and does not substitute for personal counsel or professional communication in business organization, financial, legal, or technical matters.

© 2013 TMHughes

Yuval Perry from Israel on September 16, 2013:

learning this noesis is very important. I call back proceeds understanding of the price movement is the key for success. I use unique fibonacci level which obtain the reversal point from moving ridge 2 to wave iii.

Devika Primić from Dubrovnik, Croatia on March 13, 2013:

Most informative and you certainly did a great job in enquiry. An interesting insight to this Hub. Voted up!

Source: https://toughnickel.com/personal-finance/How-To-Trade-NADEX-Binary-Options

Posted by: simmonssursen.blogspot.com

0 Response to "trading nadex weekly binary options for short term profit"

Post a Comment